FTE Definition & Meaning

Contents:

One part-time employee who works ten hours per week and one part-time employee who works 25 hours per week. Calculate the FTEs by determining the number of hours worked by full-time or part-time employees in a year. To do this, multiply the number of weeks in a year with the number of hours for a full-time position.

This means you don’t have 200 full-time employees working a full set of hours. Headcounts can easily be compared to outputs or profits using full-time equivalent. This clearly indicates how many full-time employees are needed to complete a task, project, or workload and allocate employees to departments accordingly. Based on job descriptions, HR and management can work together to decide which positions should be full-time and which ones should be part-time. Projects can then be allocated based on how much work is required and the expected delivery.

Example FTE Calculation

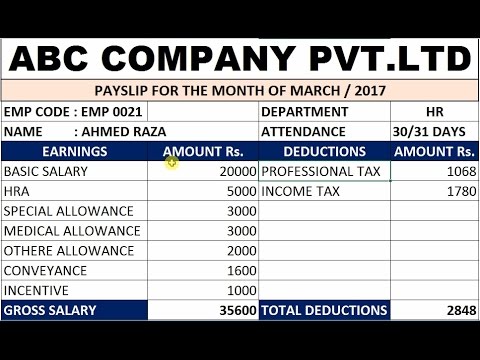

In the chart below, because both Carole and Lynn are full-time employees, they would each be counted as one FTE. However, determining the FTE for Jimmy and Marta requires calculation. FTE stands for full-time equivalent and measures how many full-time employees an organization has. A full-time employee who works 40 hours per week is equal to one FTE, and a part-time employee working 20 hours per week is equal to 0.5 FTE. Make sure you understand how federal, state, and local laws apply to your part-time, full-time, and full-time equivalent employees and create policies and practices that comply. If staffing levels aren’t maintained after the employer receives a PPP loan, the employer’s loan forgiveness amount may be reduced.

FTE (full-time equivalent) and headcount are both methods used to count members within an organization. The key difference is that FTE refers to the number of full-time hours being worked, while headcount is the number of employees in an organization. Using the FTE calculation, managers can figure out the number of part-time employees and the hours they’ll work that will add up to the same number of hours worked by full-time employees.

The result is the total full-time equivalent employees you have. Employers may decide to offer some health-care options to part-time employees as a benefit to attract more applicants. In some cases, a company might offer health care coverage for employees working as few as 20 hours in a pay period. Any employee who works an average of at least 30 hours per week for more than 120 days in a year. Part-time employees work an average of less than 30 hours per week. The look-back measurement method may not be used to determine full-time employee status for purposes of ALE status determination.

To obtain loan forgiveness, start by filling out the required paperwork, which can include the PPP Loan Forgiveness Form 3508. On Schedule A, you’ll detail any reductions to your full-time equivalent workforce’s hourly pay or salary since you borrowed the PPP money. Your loan forgiveness amount can decrease if you reduced the average number of FTE workers. meaning of fte To calculate FTE, you will need the number of part-time employees you have and the number of hours they worked. These figures can then be implemented to strategize the number of part-time employees required to accomplish tasks or projects. However, this figure doesn’t consider paid time off deductions for vacation, jury duty, sick time or holidays.

Employer Topics

Two workers working 15 hours weekly would be considered part time and their combined FTE would be one. This definition is the most commonly used to determine how many FTE you have for ACA purposes. Both Carole and Lynn in our example above would be full-time employees under this example. You can then determine the equivalent number of full-time workers you employ.

Additionally, FTE calculations give you a better sense of your current staffing levels so that you can plan and budget accordingly. Some businesses list this information in their employee handbooks or offer https://1investing.in/ letters. For example, a business might state, “Our standard work hours are Monday to Friday from 8 a.m. – 5 p.m.” If employees take a one-hour lunch, then the available hours per workweek is 40 hours .

In the last step, just divide the total number of hours of full-time employees and part-time employees by the number of regular full-time hours to generate the full time equivalent for a certain period of time. There are some exceptions when calculating FTE for the purposes of the small business tax credit. One FTE equals 2,080 hours per year and the total number of employees is taken into account rather than the number of hours they have worked. Certain employees are not included in the calculation such as owners, partners, shareholders, family members or relatives, and seasonal workers who work fewer than 120 hours per year. A full-time equivalent is a unit of measurement used to determine the amount of full-time hours worked by all employees in an organization.

This gives us a figure of 0.7, which means that Sarah is equivalent to 0.7 FTEs. In its most basic form, FTE is calculated by dividing the total number of hours worked by full-time employees by the number of hours worked by all employees. To help you determine if you are eligible for a small-employer healthcare tax credit, you need to count the number of employees employed in your company throughout the year. As stated in the Eligibility for the Small Business Tax Credit Program section above, small businesses are eligible for such a tax credit if they employ less than 50 full-time equivalent employees . To calculate the full-time equivalent for the actual full-time employees, simply do a headcount.

Paid holiday is any religious, national, or state holiday that an organization provides as paid time off. Marija Kojic is a productivity writer who’s always researching about various productivity techniques and time management tips in order to find the best ones to write about. She can often be found testing and writing about apps meant to enhance the workflow of freelancers, remote workers, and regular employees. Appeared in G2 Crowd Learning Hub, The Good Men Project, and Pick the Brain, among other places. Within this method, the employee is credited with 40 hours for each week when payment was due .

In this case, the calculation may show that the first professional is overqualified for the position, whilst the other needs more training and development. FTE can serve as a parameter for your decision-making as a manager regarding promotions, dismissals, division of tasks, training and talent development. Through this, you can identify the needs and internal capabilities of your employees more easily, as well as exercise more strategic management. The underlying period can be, for example, a day, a month or even a year.

Calculating the FTE may help you receive forgiveness regarding your student loan debt. In this particular case, your FTE must be 1.0 or 0.75 as the minimum requirement. Eligibility for the Paycheck Protection Program — Eligible employers may receive limited financial aid to cover payroll costs, benefits, utilities, rent, or mortgage interests. Such financial aid is subject to forgiveness if the borrower makes a request for it within 10 months of the end of the covered period. Moreover, in the cases of companies with a large number of part-time employees, the FTE helps to know how many part-time employees are equal to full-time employees.

- This unit of measurement is calculated by taking the average number of hours x worked per day multiplied by the number of days y worked per week.

- Headcount is a metric that calculates the number of employees in an organization at any given time.

- According to the IRS and the ACA, part-time employees work fewer than 30 hours a week on average.

- To calculate the full-time equivalent for part-time employees, add up their work hours and divide that number by 120.

Calculating FTEs will also determine an employer’s duties under the shared responsibility provisions of the Affordable Care Act. For example, a project that is estimated to take 600 hours of work can be accomplished in a variety of ways depending on your allocation of staff and time requirements. DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

Using time tracking software, like Homebase, will allow you to run a historical report based on employee work history and status to gather the average hours worked using custom fields. In addition, Homebase provides small business employers with a range of scheduling options to ensure your staff hours are within the correct range. You’ll also need to know the actual number of weekly work hours to complete the FTE calculation. Actual hours worked per week is the exact number of hours an employee worked. However, you’d want to average those hours over a time period such as four months.

Currently, employers must generally include part-time employees in a 401 retirement plan if they work at least 1,000 hours in a year, which is about 20 hours per week. However, this rule is changing on January 1, 2021, when employees who are over age 21 and work more than 500 hours a year for three consecutive years must be included. Generally, an FTEE is a way to express a part-time workforce in terms of full-time employment. This calculation is sometimes done by taking the number of total hours worked by all part-time employees and dividing by the number of hours that are considered to be a full-time schedule. To work out FTE, you must know what’s considered full-time at your company. For example, if full-time is 35 hours per week, and you have two part-time employees working 17.5 hours per week, that would total 1.0 FTE.

How Do Businesses Use FTEs?

With these tips, you can run a smoother business operation with a deeper level of understanding into your labor costs and needs now and in the future. The calculation of FTE is an employee’s hours divided by the employer’s number of hours considered a full-time workweek. First, it is necessary to determine the number of hours worked by part-time employees. Based on an FTE of 1.0, we calculate employees work 2,080 hours per year. Furthermore, this value is used only as a basis for calculating the annual FTE and reflects the hours of an employee who works 5 days a week, 8 hours a day.

Those employing an average of at least 50 full-time employees including full-time equivalent employees are considered to be an ALE. A full-time equivalent employee refers to a combination of part-time employees that add up to one or more full-time employees. All the above-mentioned factors end up costing the company something and affecting its bottom line. Under the ACA, employers must add their FTEE count to their full-time employee count to determine the total size of their workforce. This is a critical calculation because employers with 50 or more full-time and FTEEs must generally offer health coverage to their full-time employees and their dependents. These employers are also subject to specific reporting requirements.

Are owners included in FTE for PPP?

The design phase might take 35 hours, the development phase might take 40 hours, and the testing phase might take 25 hours. You are a project manager, and you are trying to make arrangements for an upcoming project. In order to get the project underway, you need to know how many hours it will take, and therefore how many people you will need. This calculation can be very confusing if you’re not used to it, so to make things as clear as possible, let’s look at an example for calculating the FTE of a single employee. However, there are a few variations on this formula, depending on what you want to include. For example, you can choose to include only paid hours, or you can include both paid and unpaid hours .

Gives insight into organizational costs

Sometimes, other terms like work year equivalent are used in place of FTE, such as when referencing a contractor or freelance employee. Determining the FTE of your company is crucial for its productivity. Imagine that, with the same FTE, an employee can deliver 100 units, while another only delivers 30.