5 Best Accounting Books for Small Business Owners

Thomas Ittelson is an expert in financial reporting and a seasoned author. With a passion for making complex understanding income before tax on an income statement topics accessible, he’s contributed significantly to financial literacy. Whether you’re a business owner, student, or professional, Ittelson’s guide serves as a foundational resource for grasping the essentials of financial reporting.

Grasp the core concepts of cost accounting, from overhead costs to variable and fixed expenses, and understand how to utilize them in business decision-making. Through simple language and illustrative examples, he unravels the intricacies of financial documentation, making them accessible to readers of all backgrounds. “Good investing is much more about the understanding of businesses and what makes them tick than understanding complex accounting details.” “Cost Accounting For Dummies” covers various crucial topics, including how to set up a cost accounting system, controlling and budgeting, dealing with variances, and making informed pricing decisions. With Boyd’s guide, you’ll navigate through the world of cost accounting with ease and confidence.

Compare the Best Accounting Software for Small Businesses

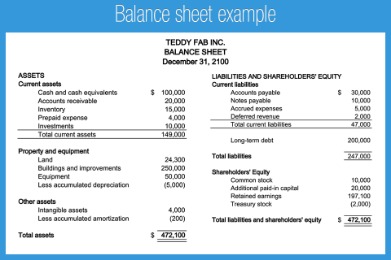

Uncover the nuances of balance sheets, income statements, and cash flow statements. Learn to interpret these documents as Warren Buffett does, focusing on long-term value and sustainability. In Accounting Made Simple, Mike Piper offers a distilled tour of accounting principles. Written with clarity and conciseness, Piper successfully demystifies the realm of accounting, making it approachable even for those without a financial background. As its title suggests, Small Time Operator focuses on solo practitioners, home businesses, small ecommerce businesses, and contractors juggling clients. If this describes you, you may find valuable financial and accounting guidance in this book, which includes best practices for bookkeeping, tax reporting, and financing your business.

How Much Does Accounting Software for Small Business Cost?

Engage further with Kenneth on LinkedIn or visit his company website for additional insights and resources. The CPA Exam Secrets Test Prep Team consists of educators and CPA professionals who work tirelessly to provide students with the best tools and strategies to approach the CPA exam. The book provides an in-depth analysis and understanding of GAAP, detailing the latest updates and amendments.

Titles worthy of consideration include Financial Statements by Thomas R. Ittelson, Small Time Operator by Bernard B. Kamoroff, and Accounting Made Simple by Mike Piper. If accounting seems like a foreign language to you, this book provides a clear and simple translation. It’s designed for ease of understanding, making it a crucial tool for non-accountants who need to familiarize themselves with financial accounting basics quickly and painlessly. The book introduces readers to the fundamentals of financial accounting in a straightforward manner. You’ll explore essential concepts, practices, and terminology, acquiring the skills to interpret and utilize financial information effectively for business planning and decision-making. This book offers a unique and engaging approach to learning accounting fundamentals, likening the process to running a lemonade stand, making complex concepts monthly personal interest expense debt servicing cost calculator accessible and enjoyable for beginners.

Accounting Methods

Stephen Penman’s “Accounting for Value” delves into the nuances of accounting from an investor’s perspective, emphasizing the role of accounting in value investing. “Mastering your financials is the first step to mastering your business.” “Numbers tell a story; your job is to understand that story and help it have a happy ending.” “Financial statements are the heartbeat of a business, revealing its health and vitality.”

Bookkeeping All-in-One For Dummies by Lita Epstein and John A. Tracy

- This book covers the fundamentals of accounting for a variety of readers.

- Stay connected with Mike through his Twitter account, or personal blog.

- From profit-and-loss statements to balance sheets and cash flow forecasts, this book will empower you with the knowledge required to take control of your business’s financial health.

- In this guide, Brodersen and Pysh illuminate the accounting principles employed by Warren Buffett himself.

- Stephen Penman’s “Accounting for Value” delves into the nuances of accounting from an investor’s perspective, emphasizing the role of accounting in value investing.

Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business. On the other hand, accountants are generally equipped with an accounting degree and may even be state-certified CPAs. You can expect most bookkeepers to maintain the general ledger and accounts while the accountant is there to create and interpret more complex financial statements. In Accounting 101, Peter Oliver unveils the core financial principles every business owner should command. He transforms intricate accounting concepts into digestible insights, making them accessible to all.

This book is designed for people who are just as interested in entrepreneurship as they are in bookkeeping. Many smaller businesses—with small numbers of financial transactions—appreciate the simplicity of a single-entry system. A double-entry accounting system can be a suitable accounting method for a business of any size, but it helps to have a trained bookkeeper recording your transactions if you use this method.

For accounting professionals, understanding GAAP is non-negotiable, and this book is an invaluable asset in mastering it. Whether you’re a student, an accountant, or an entrepreneur needing an in-depth understanding of GAAP, “Wiley GAAP 2023” should be within arm’s reach on your bookshelf. “Wiley GAAP 2023” is a thorough examination and application guide of GAAP (Generally Accepted Accounting Principles). Authored by Joanne M. Flood, it may stock compensation definition be dry, but it’s an indispensable resource for accounting professionals dealing with detailed financial reporting rules. This book serves as a comprehensive guide, delivering the skinny on bookkeeping principles and methods in a way that’s easy to understand, regardless of your business’s industry or size. With a fresh take on financial strategies, this book is an invaluable resource for entrepreneurs at any business stage.

Connect with Howard on LinkedIn, engage with Jeremy’s expertise on LinkedIn, and delve into Rohit’s contributions on his LinkedIn. In an era where transparency is vital, having the skills to discern factual reporting from manipulative practices is invaluable for professionals in finance. Shihan Sheriff brings a fresh perspective to financial education, aiming to make accounting accessible to everyone.